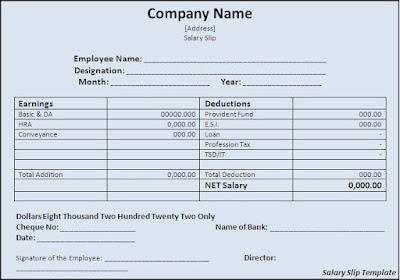

Salary Slip or Pay Slip is a piece of paper that an employee gets from his employer,

which has a record of how much is the income of a person and how much tax,

insurance etc, has been deducted from it.

Salary

Slips are very advantageous as it ensures and validates that a person is

working with the respectable firm or the company having goodwill in the market.

These Salary Slips are also beneficial for a person to borrow the finance or

mortgage loan from the banks, as the residential address and other valuable

information is mentioned on it. Therefore, these slips act as a strong evidence

for smother release of loans from bank.

Salary

Slips contain some crucial elements which are as follows:

1. Basic Salary – This is the amount you take home to your family. It

is a crucial element of salary slip as

many other components are structured around it.

2. House Rent Allowance – As the name suggests house rent

allowance is given to the employee if he is living in rented accommodation. HRA

is calculated as a percentage over basic salary generally it is 40 to 50

percent of basic salary.

3. Medical Allowance – Employers can provide any amount

as medical allowance (not more than basic) but out of it only rs.1250 per month

or rs.15000 per annum is tax free.

The

above mentioned details and allowances generally form the gross salary but

there are few deductions as well which are as follows:

1. Provident Fund – 12 percent of basic salary is deducted every month

from basic salary and is deposited in provident fund account.

2. Income Tax Deduction – In the beginning of the year,

employer asks the employee for declaration of saving which he/she will do in

current year to calculate the tentative tax for the year. The employer deducts

the TDS every month from salary of employee based on that calculations.

Therefore, Salary Slips are an important record

of salary disbursement.

DSDSDD

ReplyDelete